HMBradley

Head of Ops

A team of product specialists, managing the development of FinTech products, such as deposit accounts, credit accounts, and fraud at a high-growth startup.

Year

2020 - 2023

Company

HMBradley

HMBradley Product Suite

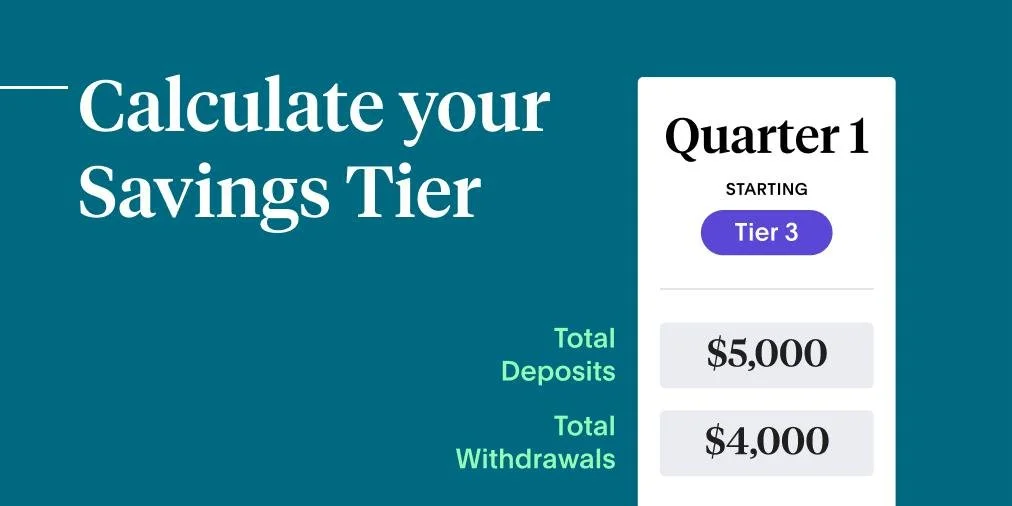

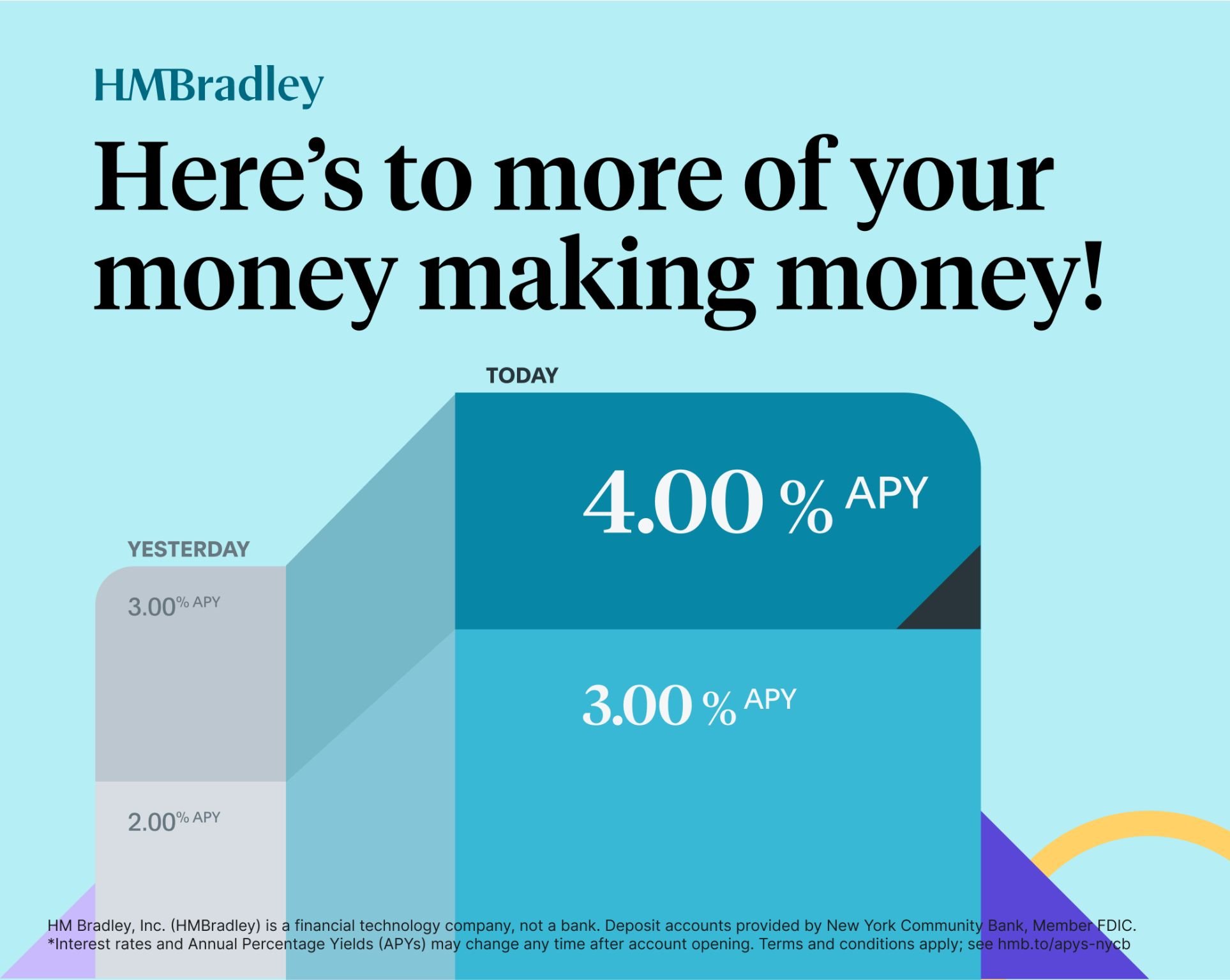

High-yield digital deposit account with unique saving tier feature

Credit card with 3-2-1% cash back based on user spending habits

Credit score and monitoring, free feature available to anyone

Scaled the deposit, credit, and fraud operations from the ground up, including building policies and procedures, building internal tooling, onboarding external vendors, and collaborating with stakeholders to ensure all products were operating efficiently and meeting banking standards at a high-growth fintech startup.

Accomplishments

Develop daily processes and procedures such as exception management and KYC

Built an escalation process for CX to refer cases to Ops

Partnered with engineering to create dashboards/ internal tools for monitoring holds/ ACH returns/ overdrafts

Formed as banking domain expert for product and engineering teams during new product launches and managing existing products

Managed vendor relationships to ensure card and payment operations were exceeding OKRs

Enhanced the dispute process to streamline UX

Established numerous processes such as 1099 reporting, dormant account closures, bank partner migration, core migration, automated transfer limit increases, automated hold decreases/ increases, and interest reviews and adjustments

Deposit OpsRefined onboarding models based on fraud trends to decrease losses

Managed large-scale fraud attacks with minimal losses, which Fintechs are typically targets of

Developed transaction monitoring dashboards and internal tools to scale a fraud operations team

Oversaw the creation of SARs, OFAC reports, internal fraud reports to document any suspicious activity

Implemented a new vendor to improve the CIP, which led to decreases in fraudulent accounts

Formed as fraud domain expert for product and engineering teams during new product launches and managing existing products

Achieved record-breaking fraud losses as a high growth Fintech with over 500B in deposits

Established numerous processes and monitoring to capture risky events including PPP fraud. monitoring, unemployment fraud, ACH fraud, micro deposit fraud, RDC fraud, account takeover and clustered accounts and applications

Fraud OpsDeveloped monitoring to capture rewards abuse and first party fraud

Collaborated with internal/ external vendors to implement a collections process

Managed the card servicing models to ensure users experienced frictionless experiences

Established numerous processes such as balance transfers, check payments, ACH return payments, credit balance refunds, and charge-offs

Formed as credit domain expert for product and engineering teams during new product launches and managing existing products

Credit Ops